Implementation Status of Corporate Governance

Director Selection

The “Articles of Association” of our company stipulate a comprehensive candidate nomination system for the election of directors. The “Director Election Regulations” and “Corporate Governance Practices Guidelines” specify that the composition of the board of directors should consider diversification. In addition to possessing professional backgrounds and skills, consideration should also be given to the company’s future development, long-term strategic planning, and the diverse professional knowledge required by the company. The selection process for board members adheres to the principles of fairness, openness, and impartiality to select individuals with the necessary expertise, practical experience, and technical competencies to fulfill their duties as directors, thus achieving the ideal goal of corporate governance.

Execution Situation of the Company

In response to operational needs, the board of directors of our company is composed of nine members. In the framework of the company’s future development and long-term strategic planning, we seek suitable board members, whether general directors or independent directors, who are characterized by integrity, responsibility, innovation, and decision-making ability. Personality traits that align with the company’s core values, relevant industry experience, as well as factors such as gender and age balance, are considered in the selection process to form the best board of directors, promoting the company’s development and maximizing its interests.

Each director is required to complete at least 6 hours of continuing education annually during their tenure to assist them in continuously updating their knowledge and maintaining their core values and professional advantages and capabilities.

The company also stipulates the “Director Performance Evaluation Method.” An evaluation is conducted annually, measuring the effectiveness of the board through internal self-assessment and self-assessment by board members. This evaluation helps confirm the effectiveness of the board’s operations and assesses the performance of directors, serving as a reference for future director selection.

Succession Planning for Key Management Levels

- Employees at department head level (Grade 9) and above are considered key management personnel and potential successors. They are responsible for overseeing relevant business and operational management within the organization. Each management level has designated deputies to ensure continuity of duties. In addition to possessing the necessary professional skills and experience, key management personnel must align with the company’s corporate culture in terms of values and management philosophy. Their personal qualities must include integrity, vision, innovation, and the ability to earn the trust of both employees and customers.

- Through monthly participation in group management meetings, collective involvement in training and continuing education programs related to important operational decisions, and rotations, project assignments, and group ideology advocacy, we strengthen management capabilities, cultivate multifunctional and forward-thinking leadership, and enhance decision-making execution.

Execution Situation of the Company

- In July 2022, Manager Chen Ruisui from the Audit Department exchanged positions with Manager You Yajing from the Finance Department, with Manager Chen Ruisui assuming the responsibilities of the Finance Department and Manager You Yajing transferring to the Audit Department.

- In March 2023, Deputy Manager Chen Jinnong from the Management Department was transferred to Factory Two to oversee manufacturing management.

- In March 2023,Shipping Department Supervisor Lin Sukui concurrently assumed responsibilities in the Human Resources Department, overseeing employee education and training planning and student management. Through job rotations and training, we aim to develop future key management personnel and successors.

- In May 2024, Mr. Su Chieh-Liang and Mr. Lin Yu-Cheng were promoted to Assistant Vice Presidents of the Company. Their appointments aim to leverage their extensive industry experience to further enhance the Company’s operational effectiveness and maximize overall performance.

- In June 2025, Vice President Mr. Huang Kung-Long was promoted to the position of President (General Manager) of the Company.

The board of directors of our company completed the assessment of the independence of certified public accountants in the 114th year of the Republic, and obtained the declaration of absolute independence issued by the certified public accountants. The assessment results were reported to the Audit Committee and the Board of Directors for deliberation on February 25, 114th year of the Republic, and relevant assessment items are as detailed in 1-1.

In the 112th year of the Republic, the board of directors resolved to amend the ‘Corporate Governance Best Practices Guidelines’ and stipulated that regular (at least once a year) reference should be made to the Audit Quality Indicators (AQI) to assess the independence and suitability of appointed accountants. The results were reported to the Audit Committee and the Board of Directors for approval. The independence and suitability of the accountants appointed by the company were assessed based on the Audit Quality Indicators (AQI) by the board of directors’ unit of the company in the 113th year of the Republic. They all met the company’s standards of independence and suitability, qualified to serve as the company’s certified public accountants, and obtained the declaration of absolute independence issued by the certified public accountants. The assessment results were approved by the Audit Committee and the Board of Directors after deliberation on February 25, 114th year of the Republic, and the relevant assessment key items are listed as detailed in 1-2.

1-1 Auditor Independence Assessment Criteria

| Assessment Item | Yes | No |

| 1.Not an employee of the company or its affiliated enterprises. | v | |

| 2.Not a director or supervisor of the company or its affiliated enterprises (except for independent directors of the company, its parent company, or subsidiaries in which the company directly or indirectly holds more than 50% of the voting shares). | v | |

| 3.Not a natural person shareholder who, together with their spouse, minor children, or shares held under others' names, holds 1% or more of the total issued shares of the company or is among the top ten shareholders. | v | |

| 4.Not the spouse, a relative within the second degree of kinship, or a direct blood relative within the third degree of kinship of any person listed in the preceding three items. | v | |

| 5.Not a director, supervisor, or employee of a corporate shareholder that directly holds 5% or more of the company’s total issued shares, nor a director, supervisor, or employee of a corporate shareholder that is among the top five shareholders. | v | |

| 6.Not a director (trustee), supervisor, manager, or shareholder holding more than 5% of a specific company or institution that has financial or business dealings with the company. | v | |

| 7.Not married to or within the second degree of kinship with any other director. | v | |

| 8.Does not fall under any of the circumstances specified in Article 30 of the Company Act. | v | |

| 9.Not elected as a representative of a government agency, legal entity, or its representative as specified in Article 27 of the Company Act. | v | |

| 10.Has not served as a director, manager, or held a position with significant influence over audit matters in the company within the past two years. | v | |

| 11.Whether an "independence declaration" issued by the appointed accountant has been obtained. | v |

Work Performance and Effectiveness

| Assessment Item | Yes | No |

| 1.Timely completion of the company's periodic financial statements. | v | |

| 2.Timely completion of periodic financial audits for investment subsidiaries. | v | |

| 3.Providing financial and tax advisory services to the company on an as-needed basis. | v |

1-2 Auditor Independence and Suitability Assessment Criteria

| AQI Indicators | Focus of Measurement | Meeting the Criteria |

| Aspect One: Professionalism | ||

| (1-1) Audit Experience | Whether accountants and above-level audit personnel have sufficient audit experience to perform audit work. | Meeting the Criteria |

| (1-2) Training Hours | Whether accountants and above-level audit personnel receive sufficient education and training to continuously acquire professional knowledge and skills. | Meeting the Criteria |

| (1-3) Turnover Rate | Whether the firm maintains a sufficient number of senior human resources. | Meeting the Criteria |

| (1-4) Professional Support | Whether the firm has sufficient professional personnel (such as evaluators) to support the audit team. | Meeting the Criteria |

| Aspect Two: Quality Control | ||

| (2-1) Accountant Workload | Whether the accountant workload is excessive, including the number of public issuers supervised and the percentage of accountant working hours invested. | Meeting the Criteria |

| (2-2) Audit Input | Whether the investment of audit team members at each audit stage is appropriate. | Meeting the Criteria |

| EQCR Review Situation | Whether the accountant assigned to the Quality Control Review (EQCR) invests sufficient time to review the audit case. | Meeting the Criteria |

| Quality Control Support Capability | Whether the firm has sufficient quality control personnel to support the audit team. | Meeting the Criteria |

| Aspect Three: Independence | ||

| (3-1) Non-Audit Service Fees | The impact of the proportion of non-audit service fees on independence. | Meeting the Criteria |

| (3-2) Client Familiarity | The impact of the cumulative years of providing audit services for certified clients on independence. | Meeting the Criteria |

| Aspect Four: Supervision | ||

| (4-1) External Inspection Deficiencies and Penalties | Whether the firm's quality control and audit cases are executed in accordance with relevant laws and regulations and standards. | Meeting the Criteria |

| (4-2) Supervisory Authority's Letters for Improvement | Whether the firm's quality control and audit cases are executed in accordance with relevant laws and regulations and standards. | Meeting the Criteria |

| Aspect Five: Innovation Capability | ||

| (5-1) Innovative Planning and Advocacy | The commitment of the accounting firm to improve audit quality, including the innovative ability and planning of the accounting firm. | Meeting the Criteria |

Operation of Corporate Governance and Differences from the Practices Guidelines for Listed and Over-the-Counter Companies

1. Establishing Relevant Risk Management Policies or Strategies

The company formulated risk management measures in 2020, covering various risk management categories, organizational structures, assessment procedures, and risk management policy guidelines concerning external environments, economics, politics, laws, industries, and internal operations.

2. Establishing Appropriate Environmental Management Systems

The company’s subsidiaries’ production processes are certified through ISO 9000, ISO 14000, and IATF 16949, aiming to reduce environmental pollution during production. All management systems comply with environmental regulations. The company has internally developed environmental safety management operations, actively managing environmental and occupational health and safety aspects, ensuring employee workplace safety and health, and maintaining ecological balance.

3. Enhancing Energy Efficiency and Utilizing Environmentally Friendly Materials

The company and its subsidiaries will continue to research and develop low-pollution materials to replace those used in products and recycle production waste. Efforts are ongoing to improve energy efficiency, including paperless initiatives, energy-saving measures, waste reduction, and recycling, to minimize environmental impacts.

4. Potential Risks and Probabilities of Climate Change on Current and Future Business Operations

Periodic employee awareness programs on energy conservation and carbon reduction are conducted, with the company fully transitioning to LED lighting. Greenhouse gas reduction issues are incorporated into risk management processes, continually assessing the potential risks and opportunities of climate change, actively promoting energy conservation, carbon reduction, greenhouse gas reduction, water conservation, and other waste management plans.

5. Policies for Greenhouse Gas Reduction, Water Conservation, and Other Waste Management

The Company places great emphasis on energy conservation and carbon reduction and regularly promotes related practices among employees. Reduction targets have been established, and energy-efficient equipment and processes have been adopted. Chillers and motors have been upgraded with variable frequency drives, and production processes have been optimized. Automation equipment is utilized to reduce labor consumption. LED energy-saving lighting has been fully installed across offices and factories, with smart lighting controls implemented in corridors and outdoor areas. Official vehicles are being gradually replaced with hybrid and fully electric vehicles. Document digitalization has also been promoted to reduce the use of photocopiers.

In addition, the Company has implemented water conservation management by setting a five-year water-saving performance plan, with the goal of achieving an annual water-saving rate of 1%. The total volume of industrial waste is being reduced while increasing the proportion of recyclable waste. The Company carefully selects qualified vendors for waste collection, treatment, and reuse, and promotes waste reduction and recycling to mitigate environmental risks

6. Formulating Management Policies and Procedures in Accordance with Relevant Regulations and International Human Rights Conventions

The company adheres to relevant labor laws and international human rights conventions, formulating “work rules” and “salary cycles” to protect employees’ legal rights and interests. By complying with national laws, including labor standards, employment services, and gender equality laws, the company promotes internal work rule advocacy and provides complaint channels to maintain employee rights, ensuring fair treatment and respect for all employees. No instances of child labor, forced labor, or human rights violations have occurred.

7. Implementing Reasonable Employee Welfare Measures Reflecting Business Performance in Employee Salaries

The company implements humane management and various welfare measures, allocating 2% to 10% of profits as employee compensation in accordance with the company’s articles of association, proposed by the board of directors in the form of stock or cash dividends. Reasonable employee welfare measures are established and implemented, including salaries, vacations, and other benefits, with business performance appropriately reflected in employee salaries through salary compensation committee oversight, performance assessments, and bonus distributions.

8. Providing Employees with Safe and Healthy Work Environments

The Company regularly provides employees with health examinations and a safe working environment, and implements fire prevention and disaster preparedness education, training, and drills to safeguard employees’ lives. With the goal of providing a safe, healthy, and comfortable workplace, the Company promotes health and safety management to help employees develop proper awareness and maintain physical and mental well-being.

9. Establishing Effective Career Development and Training Plans for Employees

To enhance employee skills and organizational competitiveness, internal education and training programs are developed, encouraging employees to participate in internal and external training courses. Employees are encouraged to improve themselves by participating in training courses related to different career capabilities, enhancing their professional skills, achieving career development goals, and ultimately achieving corporate operational objectives.

10. Formulating Policies to Protect Consumer or Customer Rights and Complaint Procedures

Our company does not sell products directly to end consumers. However, we maintain open communication channels with our clients and actively respond to their requests, with the goal of continuously enhancing customer satisfaction. We provide multiple contact methods on our company website, including dedicated customer service hotlines and email, through which complaints can be submitted.

All marketing of our products and services strictly complies with the local laws and international standards applicable to our clients and suppliers. Additionally, through internal audits, risk prevention measures, and employee training programs, we strengthen the protection of customer data to safeguard their rights and ensure information security. We strictly prohibit any acts of deception, misleading information, fraud, or any behavior that could harm consumer trust or rights.

11. Establishing Supplier Management Policies

The company formulates relevant articles such as subcontracting management methods and occupational safety and health management regulations. If a supplier’s contract violates its corporate social responsibility policy and significantly affects the environment and society negatively, the company reserves the right to terminate or dissolve the contract at any time, raising awareness among suppliers about social responsibility and environmental importance and observing their actual operational conditions.

12. Sustainable Development Promotion Task Force

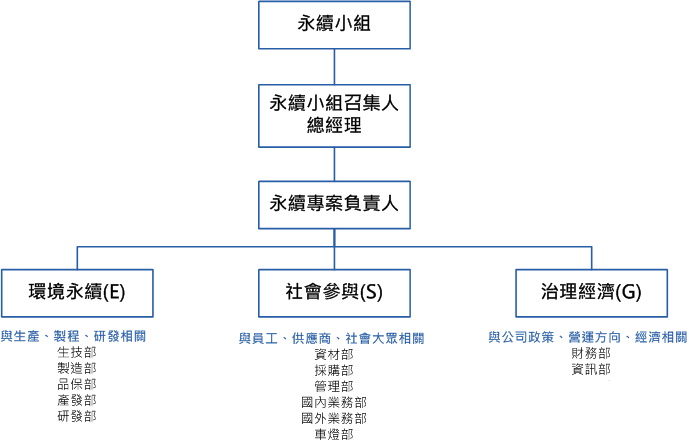

13. Progress on Sustainable Development Initiativestainable Development Promotion Task Force

- The Company’s framework for promoting sustainable development is led by the General Manager, who serves as the chief convener. The Finance Department acts as the part-time unit responsible for promoting sustainable development, while relevant functions within each department are responsible for implementation, review, and continuous improvement. Sustainability-related matters are included in policy management meetings for discussion, with regular reviews and operational management conducted accordingly. The Board of Directors supervises and provides guidance on environmental, social, and corporate governance (ESG) issues related to sustainable development.

Although the Company has not established a Sustainability Committee at the functional committee level, the General Manager, serving as the convener, has formed working groups for Environmental Sustainability, Corporate Governance, and Social Participation to promote sustainable development policies. At least one meeting is convened each year to review the Company’s management policies and the effectiveness of specific sustainability initiatives.

The chief convener of the Sustainability Promotion Task Force reports the implementation results of sustainable development initiatives and future work plans to the Board of Directors on a quarterly basis. - Based on the input from our Sustainable Development Promotion Committee, stakeholders, and internal/external experts, the Company categorized 18 ESG topics into Environmental, Social, and Economic/Governance dimensions. Significant thresholds were established according to these expert opinions to generate a materiality matrix, identifying 6 material topics.

The results were presented to the Chairperson of the Committee (the General Manager) for discussion. Given that “Supply Chain Management” is a critical operational focus for Zenitron, it was voluntarily added as a material topic for this year. Consequently, a total of 7 material topics for 2024 were finalized by the Committee and reported to the Board of Directors. Based on the assessed risks, the relevant risk management policies are defined as follows:

| Material Topic | Risk Assessment Description | Promotion Policy and Management Approach |

| Environment | Environmental Policy and Management System |

|

| Greenhouse Gas Emissions |

|

|

| Social | Occupational Safety and Health |

|

| Corporate Governance | Product Quality Management |

|

| Operational Performance |

|

|

| R&D Innovation and Management |

|

|

| ESG | Supply Chain Management |

|

The 2025 Information Security Implementation Report was presented to the Board of Directors on December 22, 2025.

1. Scope of Application

Matters concerning information security shall be handled in accordance with these regulations unless otherwise specified.

2. Resources Invested in Information Security Management

- The IT Department has assigned two personnel responsible for information security management.In 2025, employees completed a total of 12 hours of e-learning courses on the Information Security Control Guidelines.

- In 2025, newly hired employees are required to sign the “Information Security Awareness Statement for New Employees” on their first day of employment to ensure they understand the relevant regulations governing the handling and access of the Company’s internal and external information. In 2025, all employees received two hours of cybersecurity awareness training. A total of 75 employees participated, with 150 training hours completed and a 100% training completion rate.

- Information security awareness emails are issued periodically to communicate important security protection policies and precautions. In 2025, more than three information security awareness emails were distributed.

- In 2025, professional cybersecurity service providers assisted the Company with firewall connection rule backup and management consulting, backup system management consulting, and provided advanced integrated endpoint protection services. In addition, the Company invested NTD 230,000 in antivirus software licenses and NTD 118,000 in the deployment of a backup software server.

- In 2025, no major cybersecurity incidents occurred, and there were no cases or complaints regarding customer privacy breaches or customer data leaks.

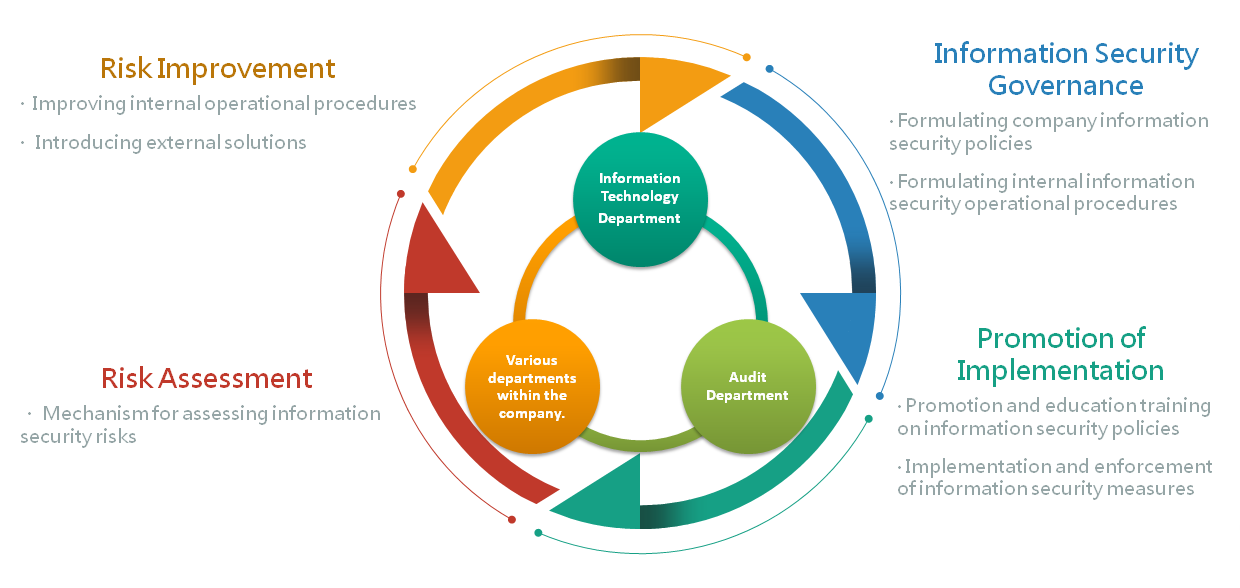

3. Information Security Organizational Management Framework

To implement information security management, the company shall establish an information security organization, which shall include senior executives of the company, responsible for promoting, coordinating, and supervising the following information security management matters:

- Approval and supervision of information security policies.

- Allocation and coordination of information security responsibilities.

- Supervision of information asset protection matters.

- Review and supervision of information security incidents.

- Approval of other information security matters.

4. Account Management

- Information systems must have account and password login management functions.

- Depending on the business functions, account types shall be distinguished, with each employee using one set of account and password for each type. Users must properly safeguard their personal accounts and passwords, with passwords being at least six characters long and changed every three months. Personal passwords must be kept strictly confidential, and if leakage is detected, they must be changed immediately to ensure information security.

- Upon changes in personnel, accounts and permissions shall be disabled or deleted according to their status, as approved by the responsible supervisor.

5. Data Access

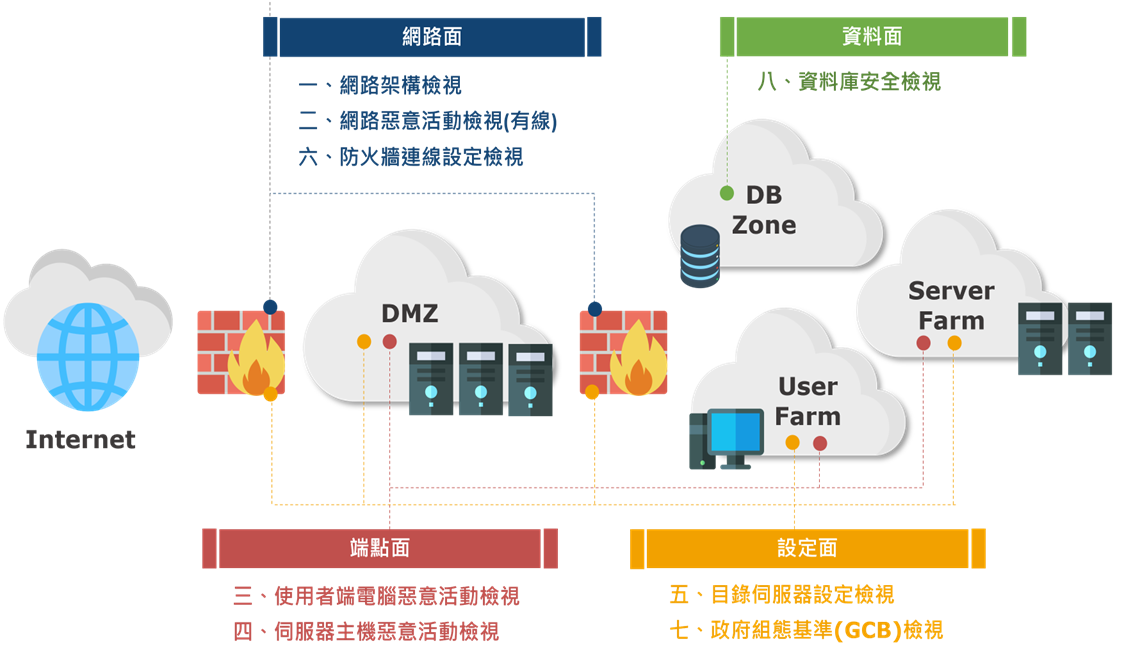

- Network monitoring systems shall be installed to monitor communication lines, protocols, data traffic, data content, and usage objects, managed by designated personnel from the information department.

- Important servers shall be installed within the company’s protected network, with internal and external networks separated by security devices (firewalls) and security access permissions set according to business needs.

- Requests for changes in firewall security permissions shall be modified by designated personnel upon approval from the information department, with the change history recorded.

- The information department shall periodically review firewall security permissions and computer network security matters, and establish a network intrusion detection system to effectively detect malicious intrusion events.

- When transmitting confidential data via public networks, data encryption mechanisms shall be employed.

- Firewall system software shall be regularly updated to address various network attacks.

6. Network Security Management

- Network monitoring systems shall be installed to monitor communication lines, protocols, data traffic, data content, and usage objects, managed by designated personnel from the information department.

- Important servers shall be installed within the company’s protected network, with internal and external networks separated by security devices (firewalls) and security access permissions set according to business needs.

- Requests for changes in firewall security permissions shall be modified by designated personnel upon approval from the information department, with the change history recorded.

- The information department shall periodically review firewall security permissions and computer network security matters, and establish a network intrusion detection system to effectively detect malicious intrusion events.

- When transmitting confidential data via public networks, data encryption mechanisms shall be employed.

- Firewall system software shall be regularly updated to address various network attacks.

7. Information Security Policies and Management Practices

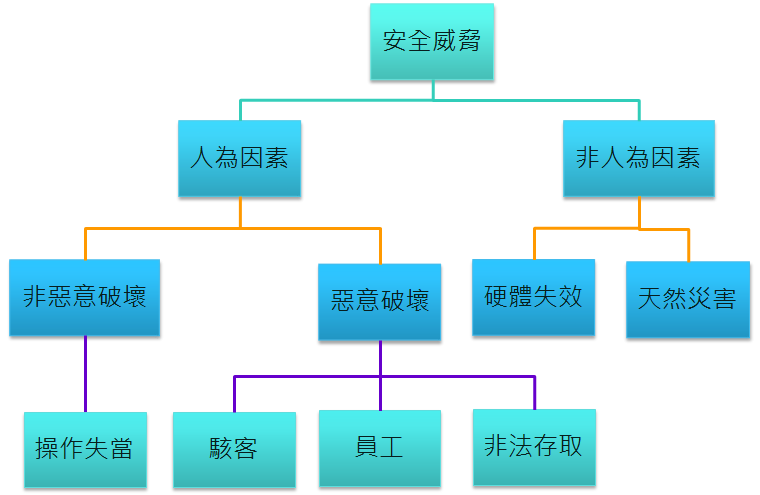

Risk Management

In recent years, global enterprises have faced significant changes in the economic environment, such as trade controls between China and the United States, disruptions caused by emerging high technologies in cybersecurity, and the spread of the Covid-19 virus. These issues have led to substantial losses for companies due to inadequate responses. Some industries, such as aviation, automotive, and tourism, have even been forced to cease operations.

To avoid potential risks that may lead to operational crises and in line with the spirit of sustainable operations, Shian Yih established a risk management organization in 2020. It formulated risk management methods and procedures to effectively monitor and reduce losses caused by risks, allowing the company to continue its operations within an acceptable risk range and achieve its business goals.

Risk management covers various external risks such as environmental, economic, political, legal, technological, and industry-related factors, as well as internal operational risks such as operational security, quality, information security, occupational health and safety, and financial risks. In addition to existing management functions and institutional regulations, cross-departmental organizations such as project teams and risk management groups are established to effectively supervise and manage risks based on the type of risk.

Types of Risks and Management Scope

| Risk Types | Considerations | Risk Explanations | Functional (Responsibility) Units |

| External Risks | Environmental, political, economic, legal, technological, and industrial changes |

|

Finance Department, General Manager/Board of Directors, Sales Department, Production Development Department, Research and Development Department, etc. |

| Internal Operational Risks | Sales |

|

Sales Department |

| Production cycle |

|

Manufacturing Department, Quality Assurance Department, Biotechnology Department, Plant Management, Production Management (Materials) | |

| Supply chain |

|

Procurement Department | |

| Information security |

|

Information Technology Department | |

| Human resources |

|

Management Department (Human Resources) | |

| Environmental and operational safety |

|

Management Department | |

| Legal compliance |

|

Management Department, Intellectual Property Team | |

| Intellectual property |

|

Intellectual Property Team | |

| Internal control |

|

Entire company, Audit Department | |

| Financial Risks | Financial |

|

Finance Department |

| Investment |

|

Finance Department | |

| Others | Other risks not mentioned above |

|

Establishment of risk project teams |

Note: The functional units (responsibility units) for managing various types of risks may change depending on practical circumstances, organizational adjustments, and appointments by the highest risk authority.

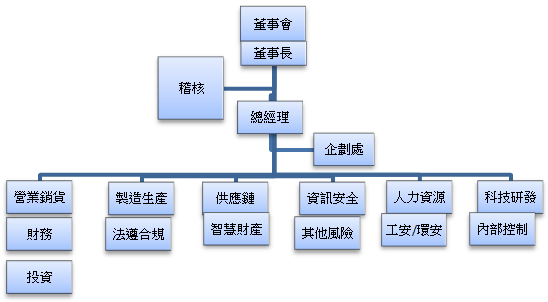

Risk Management Organizational Structure

The implementation of risk management-related operations will be carried out by relevant units and personnel based on the sources and types of risks. In addition to following existing management structures and internal control systems, unit managers will collaborate with other units according to assigned project responsibilities. The planning department is responsible for summarizing the risk management situation and reporting upwards within the authority.

| Types of risks | Risk identification | Risk control measures |

| External risks | Tariff regulations on Sino-US trade |

|

| Internal operations | Financial |

|

| Supply chain |

|

|

| Product quality |

|

|

| Occupational health and safety |

|

|

| Digital information security |

|

|

| Others | Counter-terrorism and customs cargo security |

|

The risk management procedures were approved by the board of directors on December 23, 2020. Starting from 2021, the report will be presented at the last board meeting each year. The latest risk management report was completed and presented to the board on December 22, 2025. For detailed report content, please click the link below to download.

Board Report Date: November 7, 2025

1. Integrity Management Policygulations

Integrity management is the fundamental social responsibility of a company and is beneficial to its operations and long-term development. Dishonest conduct not only causes financial losses to the company but also leads to issues such as low employee ethical standards and mistrust among customers and business partners. This may result in involvement in illicit activities such as lobbying or bribery, undermining corporate governance mechanisms and deteriorating the overall business environment.

The company’s Board of Directors exercises the duty of care of a prudent manager by supervising the prevention of dishonest conduct to ensure the implementation of the integrity management policy.

To ensure that the company and its employees deal with customers, suppliers, creditors, shareholders, and the public with integrity, the company has had the “Integrity Management Operational Procedures and Code of Conduct” and the “Code of Ethical Conduct” approved by the shareholders’ meeting. The formulation, amendment, or repeal of these policies requires the approval of the shareholders’ meeting and the Board of Directors. In addition, the company has established the “Whistleblowing System Management Procedures” as a basis for all employees’ conduct. All employees sign the “Declaration of Compliance with Integrity Management Policies” to pledge adherence to these regulations.

Corporate governance is the foundation of business operations. The company is committed to implementing corporate governance disclosure, enhancing transparency in management performance, and continuously promoting and monitoring organizational activities in compliance with domestic and international regulations to ensure sound organizational development and protect the interests of stakeholders.

2. Implementation of Integrity Management in 2025

| Assessment Items | Operational Status | Differences from Listed Companies’ Code of Business Integrity and Reasons | ||

| Yes | No | Summary / Remarks | ||

|

1. Establishment of Integrity Management Policies and Programs

|

✔ |

|

No significant differences | |

|

2. Implementation of Integrity Management

|

✔ |

|

No significant differences | |

|

3. Operation of the Company’s Whistleblowing System

|

✔ |

Channels for reporting improper conduct: (1) For improper acts related to integrity management, please send an email to shianyih8020@gmail.com or contact the whistleblowing hotline at 04-23590111#8020 (Ms. You). (2) For cases involving workplace illegal infringements or violations of current management regulations, systems, or work procedures that harm personal legal rights, please send an email to syhr@shianyih.com.tw

|

No significant differences | |

|

4. Enhanced Information Disclosure

|

✔ | The company has established a website to disclose its corporate profile and regularly publishes relevant information on the Market Observation Post System in a timely manner. | No significant differences | |

The Company has established the “Procedures for Handling Material Internal Information” and the “Regulations for Preventing Insider Trading”, which strictly prohibit company insiders from trading securities based on non-public market information. These serve as the basis for the Company’s mechanisms for handling and disclosing material information. The policies are publicly available on the Company’s website for reference, and the Company reviews them periodically to ensure compliance with current laws and practical management needs.

Implementation of Insider Trading Prevention Measures

- Upon assuming office on May 26, 2025, all newly appointed directors were provided with regulatory handbooks and materials regarding insider trading and insider shareholding regulations applicable to listed companies. These materials included legal requirements (such as insider shareholding management, common violations, attribution rights of directors, managers, and major shareholders, and prohibitions against insider trading) as well as compliance reminders. All materials were distributed to the new directors and independent directors, with receipt confirmations duly completed.

- Since the third quarter of 2022, prior to each quarterly operating results announcement, the Company has conducted training sessions for insiders and designated supervisors/employees on the requirements of Article 157-1 of the Securities and Exchange Act. The training covers reminders of silent periods, the scope of insider trading prohibitions and affected parties, types of information with material impact on stock prices and disclosure methods, as well as relevant penalties and regulatory requirements. In 2025, the Company issued four email reminders to ensure compliance and prevent potential violations.

- On November 7, 2024, the Board of Directors approved an amendment to the Corporate Governance Best Practice Principles, requiring insiders to refrain from trading Company stock during blackout periods: 30 days prior to the announcement of the annual financial report and 15 days prior to the announcement of quarterly financial reports.

- During the Company’s monthly monitoring of insider shareholding changes, communications to insiders reiterate the prohibition on trading during blackout periods (30 days before annual financial results and 15 days before quarterly financial results). The reminders also cover common errors in insider shareholding disclosures, rules prohibiting short-swing trading, and reporting requirements for share transfers. Insiders are reminded that any gains from short-swing trading are subject to disgorgement, and the Company will exercise its right to reclaim such profits.

| Financial Reporting Period | Board Meeting & Public Announcement Date | Notification Date | Trading Blackout Period |

| FY 2024 Financial Report | February 25, 2025 | January 16, 2025 | January 20, 2025 – February 25, 2025 |

| Q1 2025 Financial Report | May 9, 2025 | April 14, 2025 | April 21, 2025 – May 9, 2025 |

| Q2 2025 Financial Report | August 8, 2025 | July 21, 2025 | July 21, 2025 – August 8, 2025 |

| Q3 2025 Financial Report | November 7, 2025 | October 17, 2025 | October 20, 2025 – November 7, 2025 |

5. For new employees, online training sessions are conducted upon onboarding. Additionally, prior to each internal employee training course, a presentation session is held to promote awareness of insider trading regulations and insider-related legal obligations.

Intellectual Property Rights Report:

Report Date: December 22, 2025

Reporting Unit: Administration Department, Intellectual Property Task Group

Matters related to the Company’s intellectual property rights were reported to the 17th Board of Directors meeting in fiscal year 2025.

Intellectual Property Management System:

To strengthen technological operational growth and maintain competitive advantages, the Company positions its intellectual property strategy with a focus on enhancing patent quality rather than patent quantity. By integrating the Company’s core technologies and products with patent development, we aim to create industrial value and increase revenue.

In accordance with the principles of corporate governance, legal compliance, and relevant evaluation indicators, the Company has established a comprehensive intellectual property management system that is aligned with its operational objectives and technology development strategies.

Intellectual Property Management Objectives

- To complete at least one patent proposal in the planned technical field by 2025.

- To complete the establishment of the planned system in 2025 and ensure that all trade secret documents are archived in the internal management system within the required timeframe for tracking and reference.

- To achieve 100% completion of intellectual property and trade secret obligation awareness, declaration, and signing by all newly hired employees.

Intellectual Property Management Policy:

- Adhere to corporate governance regulations to implement IP management effectively.

- Strengthen key technologies internally and comprehensively deploy intellectual property.

- Protect and utilize research and development achievements, enhancing trade secret protection.

- Enhance employee awareness of IP to create IP value.

Annual Implementation Status and Intellectual Property Management Achievements

Implementation Status for FY 2025:

The Company implemented its Intellectual Property Management Plan accordingly and submitted the report to the Board of Directors on December 22, 2025. To ensure compliance with corporate governance regulations, the Intellectual Property Plan aligned with the Company’s operational objectives, together with its annual implementation status, will be disclosed on the Company’s official website by December 30, 2025..

Intellectual Property Inventory and Results:

| Intellectual Property Classification | Patent application in progress | Patent approved |

|---|---|---|

| Invention Patent | 2 | 3 |

| Utility Model Patent | 4 | |

| Design Patent | 1 | |

| Trademark | 14 |

Trade Secret Document Inventory (2025/1/1~2025/11/30)

| Classification | Quantity | Description |

|---|---|---|

| New Employees | 4 | |

| Customers | 6 | |

| Supply Chain | 2 |

Contribution of Intellectual Property Rights to Corporate Operations:

1. Enhancement of IP Energy:

Patented technology is an important intangible asset for our company. We offer internal proposals and external application incentive measures annually to encourage R&D staff to protect their research results. Through an internal review mechanism for proposal applications, we can flexibly adjust patent application categories and countries based on the proposal’s technology, application aspects, and market trends to maximize the utility of patent protection.

2. Deepening Employee Awareness of IP:

The company actively promotes awareness of intellectual property (IP) protection to all employees through internal activities such as training sessions, weekly meetings, and seminars. Only when all employees share a common understanding can unintentional infringement of others’ or the company’s intellectual property be avoided, thereby preventing potential litigation and compensation claims that could affect the company’s financial performance.

Employees are encouraged to frequently participate in external patent and technology seminars to stay informed of rapidly evolving technologies and confidential information through patent searches. At the same time, employees are reminded to strictly follow relevant guidelines during the search process, enabling them to take appropriate measures in the event of any patent-related risks or incidents.

3. Achieving Sustainable Business Goals:

Each year, we conduct education and training for new and existing employees to promote an understanding of the importance of IP rights. We hope that all employees will work together to protect the company’s intellectual property, thereby achieving our corporate sustainability goals.

Intellectual Property Rights Risks and Countermeasures:

Since 2024, our company has actively invested in the development of new products and technologies, including levitating displays, head-up displays, and curved light guides. Although comprehensive intellectual property (IP) management systems have been established internally, the innovation and transformation process may still face challenges such as patent demands and ownership concerns. The company’s foremost principle is to protect its market, products, technologies, and customers.

For example, patents for core and innovative products are prioritized for independent acquisition. In addition, external collaborations and patent acquisitions are pursued. In 2025, the company entered into relevant patent cooperation and licensing projects with the Industrial Technology Research Institute (ITRI) of Taiwan.

Even under comprehensive control plans, when risks arise, the company immediately applies its risk management procedures to handle disputes. Strategies for dispute resolution are formulated through technical, legal, and industry analyses. Various approaches are employed, such as establishing technical entry barriers against competitors or ensuring that no infringement occurs on others’ patents, taking a holistic approach to IP risk management.